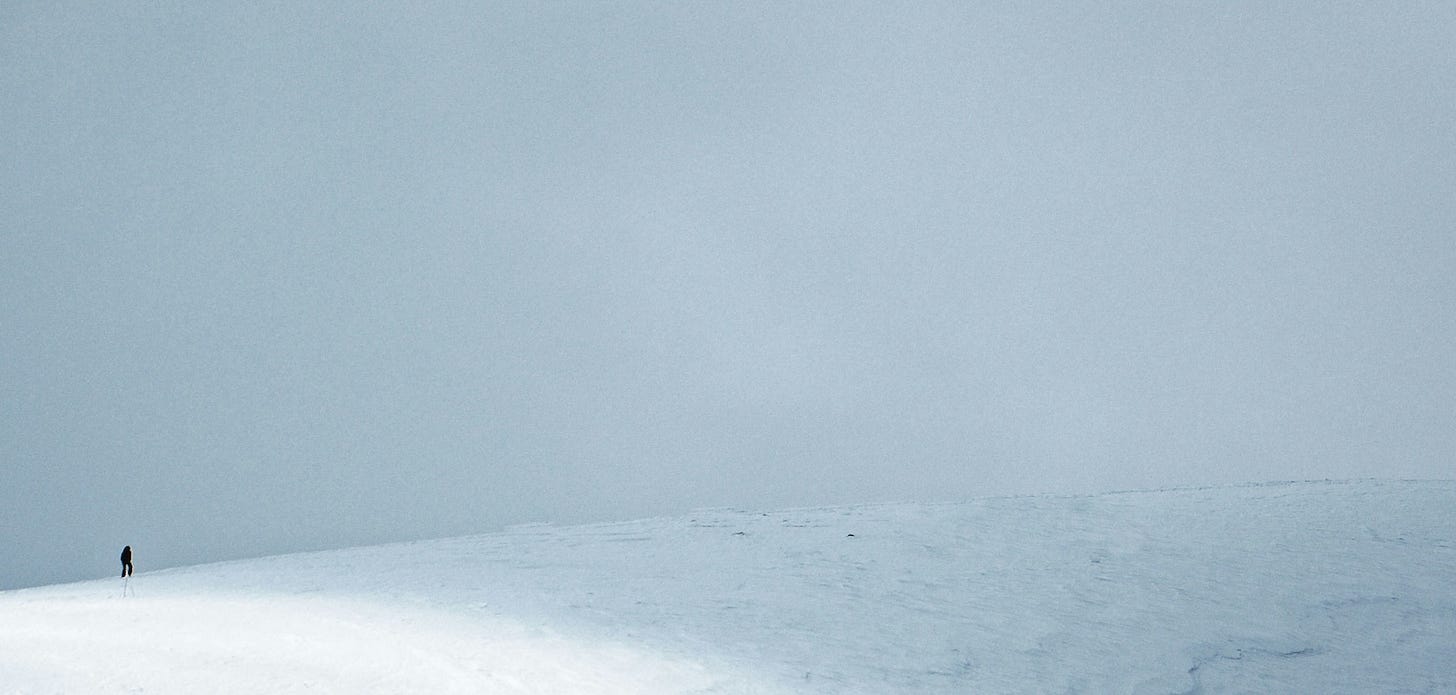

Signal-Grade Data is the data that didn’t exist until you asked the right questions and had the right AI to answer them

Beyond the Data Commodity: Why Signal-Grade Data Is the Real Alpha

In today’s capital markets, and many other industries, data is the new oil — or the new rare earth metals if you’re following the current market. But not all data holds value, and a lot of it is just commodity, even in the world of finance. And with the AI boom, more of that data is going to be noise. That’s not to say its unimportant but it doesn’t necessarily fuel performance or accelerate your understanding and need for insight — insight that moves the needle. Or gets you out of the abyss.

For years, the finance industry has been obsessed with harvesting "hard data": structured numbers in spreadsheets, financial statements, or backward-looking KPI metrics. While valuable, this kind of data is often inaccessible in private markets, riddled with reporting gaps, and fundamentally limited in its predictive power.

Worse, the obsession with raw numerical data — without context or causal insight — creates a dangerous feedback loop. We’ve seen the rise of data incest: where similar datasets are copied, repackaged, and recycled across models and dashboards with minimal differentiation. The result? An illusion of precision. A brittle foundation for decision-making. And a real risk of crowding around the same lagging indicators.

At Charli, we’re taking a fundamentally different approach.

From Data Hoarding to Signal Generation

We believe the future of AI in capital markets isn’t about collecting more data — it’s about manufacturing better data.

This is not synthetic data, and it’s not simulation. This is Signal-Grade Data: real-world, context-rich, high-integrity data engineered through multi-layered reasoning models and agentic AI workflows — consistently structured, precisely labeled, and optimized for downstream analysis. It’s built for traceability, repeatability, and predictive utility.

This new class of data is not pulled from filings or scraped from the web. It is constructed through complex reasoning — built by running what-if scenarios, market narratives, deal signal inference, and ecosystem intelligence through Agent-to-Agent (A2A) architectures, layered reasoning, and advanced scoring heuristics. Think of it as data that didn’t exist until you asked the right questions and had the AI systems capable of answering them.

Why Signal-Grade Data Matters Now

Signal-Grade Data doesn’t just describe the world — it explains it.

It enables high-fidelity, low-noise decision signals that outperform traditional, backward-looking methods. And because it is based on real-world reasoning, not model simulation, it provides:

Causal insight, not just correlation

Leading indicators, not trailing facts

Injectable features for AI models that won't collapse under distribution drift

We see this as a key to unlock modern financial infrastructure: generating and utilizing dynamic, explainable, and professional-grade datasets that become ground truth streams — time-series insights you can track, trend, and benchmark across sectors, deals, and risk factors.

This is what makes Charli’s approach different from conventional LLM-powered tooling and surface-level market analytics. Our AI systems don't just summarize or extract. They reason, score, and generate differentiated views of the market that traditional quant methods cannot reach.

Why This Matters to Leaders

The implications of Signal-Grade Data extend far beyond the buzzwords of AI and big data. For investors, it offers a sharper lens into market behavior; revealing directional signals and narrative shifts before they show up in traditional price action or analyst consensus. Rather than relying solely on quarterly earnings or spreadsheet metrics, investors can act on forward-looking indicators grounded in professional-grade reasoning and contextual intelligence.

For CIOs and enterprise data leaders, this marks a shift in infrastructure thinking. Instead of passively warehousing data and retrofitting governance on top of legacy pipelines, Signal-Grade Data enables proactive data generation and orchestration. It's a paradigm where AI doesn’t just analyze what's stored — it produces what’s missing: data that drives strategy, enhances risk models, and informs real-time decision workflows across the business.

And for technical teams — from quants to data scientists — this unlocks a new layer of model design. Signal-Grade Data enriches feature sets with context-aware variables that are consistent, trackable, and relevant. It mitigates the brittleness of synthetic augmentation, supports better generalization in predictive models, and opens up entirely new domains for supervised and unsupervised learning — especially in high-stakes, opaque environments like private markets.

This is not just better data. It's better intelligence.

And it’s giving a strategic edge to those who know where to look.